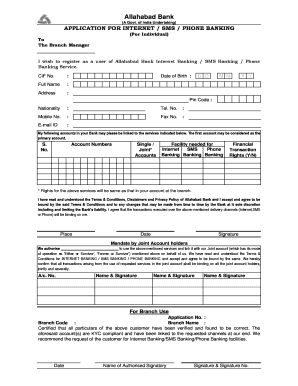

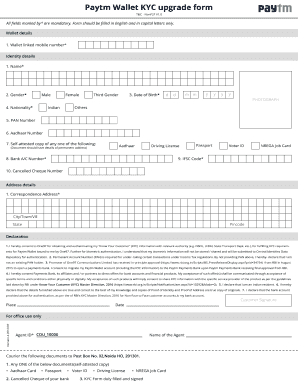

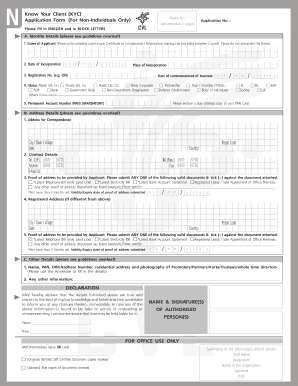

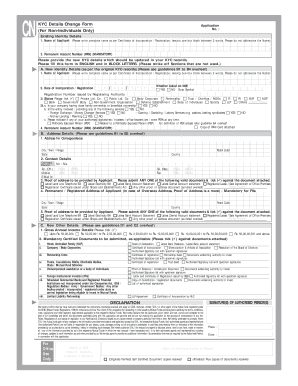

KYC Application Form free printable template

Show details

Please submit a photocopy of the duly completed KYC Application Form. alok graphics For assistance or enquiries please approach the Point of Service where you had submitted your KYC Application Form.. Please note that your signature on the KYC Application Form should match with that on the records of the Mutual Funds. GUIDELINES FOR FILLING UP THE KYC APPLICATION FORM General 1. The Application Form should be completed in ENGLISH and in BLOCK LETTERS. 2. However acceptance and processing of...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign kyc form

Edit your icici bank kyc form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your icici kyc form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kyc application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit individual kyc template form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out icici kyc form download

How to fill out KYC Application Form

01

Gather Required Documents: Collect necessary identification documents such as a government-issued ID, proof of address, and, if applicable, tax identification number.

02

Download the KYC Application Form: Obtain the KYC form from the relevant institution's website or office.

03

Fill in Personal Information: Provide your full name, date of birth, nationality, and gender in the respective fields.

04

Enter Identification Details: Input details from your ID, including document number and expiration date.

05

Provide Contact Information: Fill in your current residence address, email address, and contact number.

06

State Financial Information: If required, provide information about your source of funds and income.

07

Review the Information: Double-check all entries for accuracy and completeness.

08

Sign and Date the Form: Ensure you sign and date the form where required.

09

Submit the Form: Send the completed form along with photocopies of required documents to the respective institution via online or in-person.

Who needs KYC Application Form?

01

Individuals opening a bank account.

02

Investors looking to trade on stock exchanges.

03

Customers of financial institutions such as insurance companies.

04

Businesses establishing accounts with financial service providers.

05

Cryptocurrency exchanges and wallets for account verification.

Fill

know client kyc form

: Try Risk Free

People Also Ask about kyc update online

What is the KYC form?

KYC means Know Your Customer and sometimes Know Your Client. KYC or KYC check is the mandatory process of identifying and verifying the client's identity when opening an account and periodically over time.

How do I create a KYC form?

Common KYC checklists for business to business (B2B) relationships include: Registered company name. Registered company address. Nature of business. Type and status of the business. Name of bank. Company reference or registration number/ VAT number. Company branch. Account number/ IBAN/ Swift code.

What should be included in a KYC form?

KYC process includes ID card verification, face verification, document verification such as utility bills as proof of address, and biometric verification.

Who to fill KYC form?

A KYC form is a document filed by an individual applying to become a customer/investor of a financial or similar institution in India. The form usually contains a selection of verification data and documents. For example, a person may be requested to provide and proof their name, address, marital status, and job.

How do I prepare a KYC form?

Offline method Download the KYC form from the official website of the financial institution. Fill the form with and mention your Aadhaar and PAN details. Visit a KRA offline center and submit the application. Attach the identity and address proofs with the KYC form.

What is an example of a KYC?

Examples of KYC documents include a passport, driver's license, or utility bill. KYC is a critical process for determining customer risk and whether the customer can meet the institution's requirements to use their services. It's also a legal requirement to comply with Anti-Money Laundering (AML) laws.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in icici kyc form pdf without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit individual kyc form download and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an eSignature for the individual know kyc in Gmail?

Create your eSignature using pdfFiller and then eSign your know your kyc application immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit individual know client on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing individual kyc right away.

What is KYC Application Form?

The KYC (Know Your Customer) Application Form is a document used by financial institutions to verify the identity of their clients and assess potential risks of illegal intentions for the business relationship.

Who is required to file KYC Application Form?

Individuals and entities engaging in financial transactions with banks, investment firms, and other financial institutions are required to file the KYC Application Form.

How to fill out KYC Application Form?

To fill out the KYC Application Form, provide personal information such as name, address, date of birth, nationality, and identification documents. Ensure all information is accurate and complete to avoid delays.

What is the purpose of KYC Application Form?

The purpose of the KYC Application Form is to prevent identity theft, money laundering, and fraud by ensuring that the financial institution knows the identity of its clients.

What information must be reported on KYC Application Form?

The KYC Application Form must report personal identification information including full name, date of birth, permanent address, current address, occupation, income details, and official identification documents like a passport or driver's license.

Fill out your KYC Application Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Icici Kyc Documents is not the form you're looking for?Search for another form here.

Keywords relevant to individual kyc online

Related to icici bank kyc update form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.